One significant effect of the COVID-19 pandemic is the expansion of the remote workforce. When offices shut down in March 2020, many employees set up shop in home offices and never went back. Some companies have found a hybrid model that works well for both employers and employees. The work-from-anywhere trend is going strong, catering to people who value travel, variety, and flexibility in the workplace. But how does governing law affect this new model?

Governing law affects myriad areas of employment: employment agreements, pay schedules, taxes, leave requirements, meal and rest breaks, COVID-19 prevention policies, and insurance requirements. All of these factors require a company to be able to determine where an employee is considered to be employed, and that can be complicated.

Governing Law and Flexibility in the Workplace

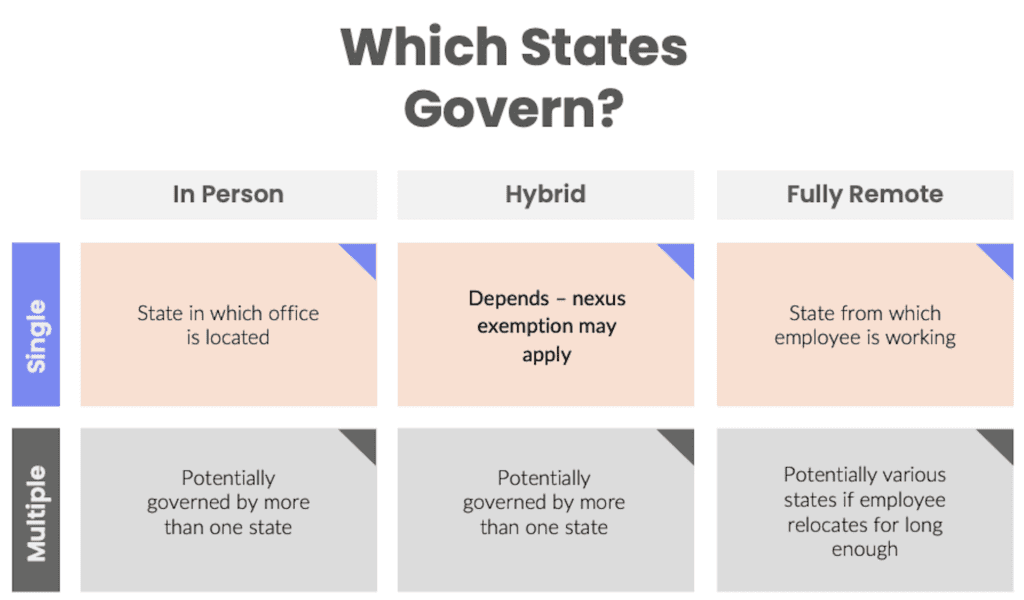

The simplest situation to ensure compliance with governing law while allowing for flexibility in the workplace is when the employee works in-person at the office. For a fully remote employee, the applicable governing employment law is the state where the employee works. If the employee works in the office some days and at home in a different state on other days, multiple jurisdictions will need to be considered to determine the applicable governing law. Fortunately, there are some states that have passed special pandemic exemptions to help in these situations. If there is an employee who typically works in the office, but is working at home in a different state only because of the pandemic, nexus exemption in these jurisdictions allows the company to consider the employee’s work location to be the same as the office, so the governing employment law is the state where the employee works.

In the situations where more than one state law applies, employers should make their agreements consistent with the state whose laws are more generous to the employee and less generous to the employer. Then, if an issue arises resulting in litigation in the less preferred state, the employee agreements would be more likely to be upheld because it complies with the laws of the more strict state.

Businesses should specify the jurisdiction of governing law in their contracts, and consider whether that choice will be recognized by a court. Here are some examples to help employers determine the appropriate jurisdiction of governing law, especially during a time of increased flexibility in the workplace:

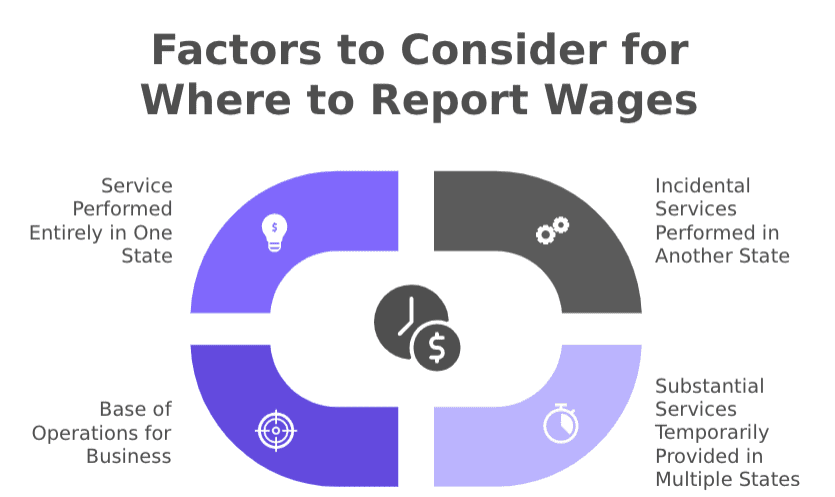

- The employee’s services are performed entirely in one state. This is the simplest situation as the state where the office is located is the applicable governing law.

- The employee’s services are performed in a second state, but those services are incidental. The state where the employee performs their substantive work is the applicable governing law.

- The employee’s substantial services are temporarily provided in multiple states. This is a more complicated analysis. In this case, employers should consider where the employer performs most of its operations. Employers should explicitly state in their contracts where different state laws might apply for different employment considerations. For instance, what law governs arbitration? How about non-disclosure agreements? One major consideration is to what state or states to report an employee’s wages for tax implications. Employers can determine where to report an employee’s taxes through a localization test.

Localization Tests

Localization tests determine which state has the most compelling interest to tax an employee’s income. The Department of Labor uses a localization test to determine the state in which to report an employee’s taxes. This determination is specific to income tax and not necessarily other employment policies and agreements, but it might be a helpful test to indicate what kind of governing law may apply to the other agreements.

Localization has four different questions to determine where to report the employee’s taxes. Employers can evaluate the questions and weigh the responses to determine where the employee has a significant nexus and should be taxed.

- Localization. Does the employee perform services in this state? Are the services performed substantial or incidental? If the services are substantial, then the analysis typically ends here and that state law applies.

- Base of operations of the employee. If the employee’s service is not localized in any state, does the employee perform some service in the state in which the employee’s base of operations is located? This is the established location where the employee’s workday begins and ends. If the employee has a base of operations in a particular state, then the analysis typically ends here and that state law applies.

- Company’s place of direction & control. If the employee does not perform any service in the state of the employee’s base of operations, does the individual perform any service in the state from which the service is directed and controlled? This is typically the company’s base of operations. If there is no localization or base of operations for an employee, but the company directs and controls an employee in a state, then typically that state law applies.

- Residence of employee. If the employee does not perform any service in the state from which the employee’s service is directed and controlled, does the individual perform any service in the state in which the employee lives? If no other questions provide a conclusive answer, then it may be helpful to use the state of the employee’s residence as the governing law.

Best Practices for Flexibility in the Workplace

When employers are entering into agreements with employees, one best practice is to have the employee sign a document agreeing that the governing law is the state law where the employee originally agreed to work, and to have a hybrid working policy that applies if the employee works in other locations. That approach gives the employer the ability to execute a new agreement if the employee decides to move to another state. This allows for both compliance to the governing law and flexibility in the workplace.

SixFifty Solutions

SixFifty can help! Our Employment Agreements toolset helps companies to stay compliant while allowing for flexibility in the workplace. We help businesses write offer letters, employee contracts, separation agreements, non-disclosure agreements, and more. Working with SixFifty is like having a panel of top-tier employment lawyers by your side to create and update your policies and documents as your company and the laws change.

If you are ready to get started or have any questions, schedule a demo with SixFifty today!