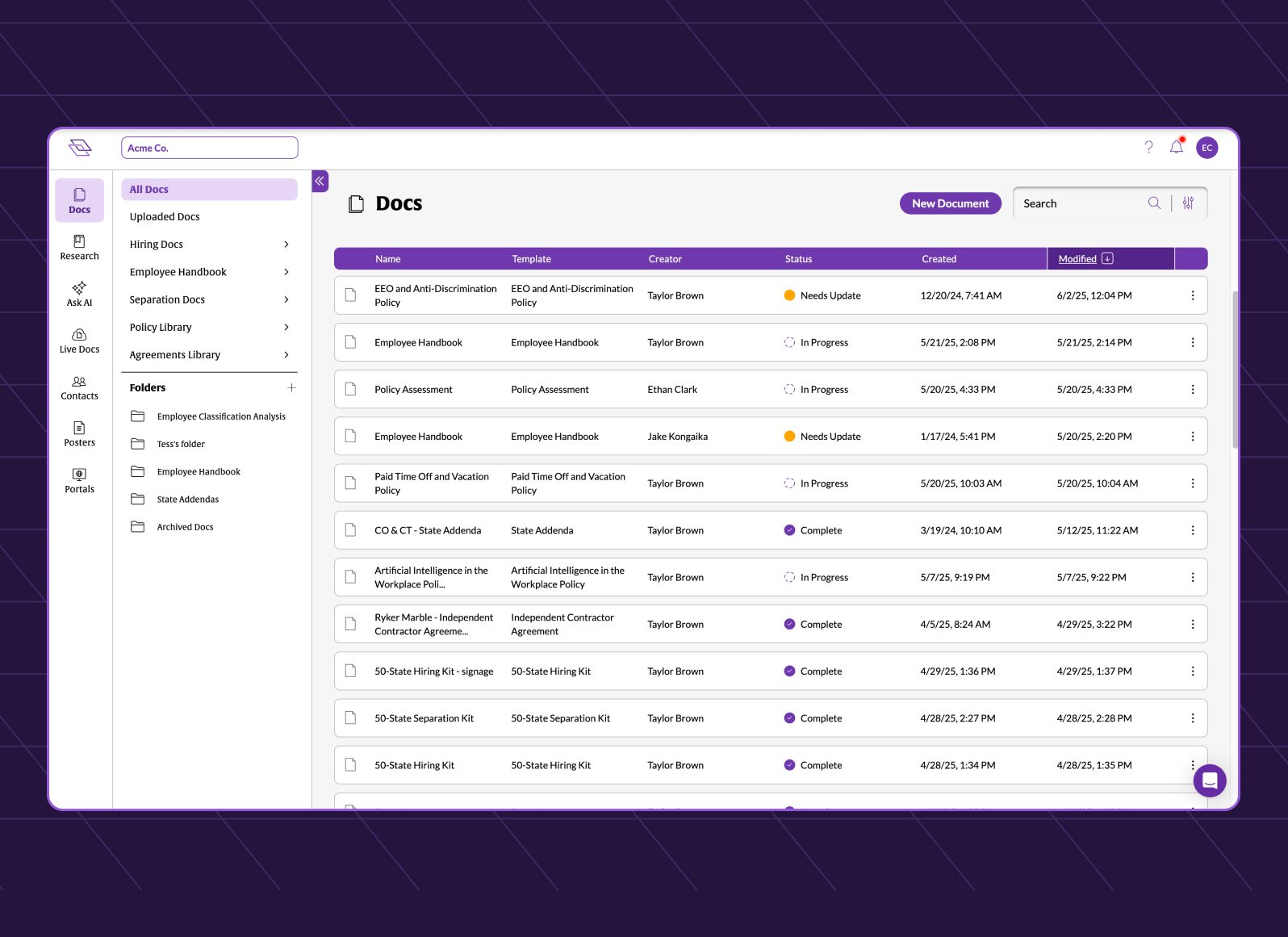

Worker Classification: Navigating New Rules and Pitfalls

Accurately determining whether your workers are independent contractors—or exempt from overtime and minimum wage regulations under FLSA—is a challenge that causes headaches for HR teams across the country.

And this year, that challenge has gotten even harder.

Between the Department of Labor's recent changes to salary thresholds and how employees are classified, to the Supreme Court's decision to end Chevron deference (a long-standing legal doctrine that required courts to defer to federal agencies' interpretations of federal statutes, including those around worker classification), there is a lot of uncertainty around how businesses should be classifying their workers.

Join SixFifty's employment law experts for a discussion on how to navigate these complex issues, including:

- The tests you should be using to classify your workers properly under federal and state law

- Potential pitfalls that could lead to the misclassification of workers (and the effect misclassification could have on your business)

- How recent changes in the law have affected how businesses should strategically approach worker classification

- The long-term implications for worker classification rules in a world without Chevron deference, and more